BPS warns of recent scam calls, card fraud

Published 3:26 pm Friday, September 28, 2018

Bainbridge Public Safety is warning residents to be alert when taking phone calls from strange numbers and when handling their credit and debit card information.

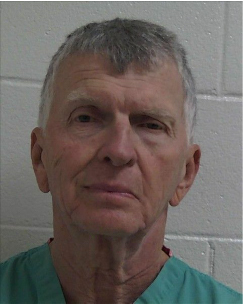

“A lot of times if they are asking for personal info or an account number or money, or offering you money but you have to pay something before you get your winnings it is 100 percent a scam,” said BPS Deputy Director Frank Green.

According to Green, there have been multiple walk-ins over the past few weeks concerning fraudulent charges on credit and debit cards. While tracking and stopping the criminals who steal information to commit this kind of financial fraud, Green said there are things residents can do to stay on top of it.

“I suggest that all citizens need to regularly monitor their statements on a daily basis, just to try to stay alert,” said Green. “That’s the best way to battle it.”

The main problem with these types of cases, and law enforcement’s ability to solve them, is the perpetrator that is using someone else’s financial information is extremely difficult to track.

Green said the same problem can be said for scam phone calls, as they often involve criminals from other countries and other jurisdictions. Scam phone calls can even come from local phone numbers, he said, and sometimes may appear on your smartphone as a number or name you recognize.

“The best way to fight it is for the consumers to be educated of these type of things,” said Green.

Use these general best practices for credit card safety, which you should be implementing daily to protect yourself from fraud:

Sign any new cards immediately. By establishing your signature on the card, you make it much more difficult for someone else to erase or cover your signature and forge it in their own handwriting if the card is ever lost or stolen.

Carry your cards separately from your cash. Most people carry their cards and cash together in their wallet, but that means if your wallet is stolen, your cards will be stolen as well.

After you hand your card over to pay, keep it in view when you can.

Don’t sign a blank receipt. Draw a line through any space above the total amount (including any tip amounts) if you do not intend to authorize additional charges on your card.

Void all carbon copies and incorrect receipts.

Save all receipts in a safe place.

Open your billing statements as soon as you get them, and reconcile your card accounts every month the same way you would reconcile your checking account.

Report any suspicious activity on your card immediately.

Never lend your credit card.

Always destroy receipts by using a shredder or cutting them into small pieces.

Never leave receipts lying around.

Never put your card number on a postcard, the outside of envelopes, or in a photo online.

Do not give out your card number over the phone unless you initiated the transaction and you know the company is reputable.

Almost everyone is shopping online nowadays, and it’s important to understand how you can protect your personal information when doing so. Here are some quick tips:

Only use your card for purchases on websites you trust.

Do not click links in emails, especially those from any company or individual you don’t recognize.

Never enter your card information (or social security number, etc.) in response to an email or via an emailed link. Always go directly to the company’s site instead by typing the address yourself.

When entering card information, check the page you’re on to make sure it’s secure (e.g., starts with https:// or includes a lock symbol in your browser bar).

Use a credit card (not a debit card) to limit your liability for any fraud that may occur.

Watch your transaction history — make sure transactions match the amounts on your receipts, and look out for anything you don’t recognize.