First National Bank supports Memorial Hospital and Manor through Georgia HEART

Published 1:03 pm Wednesday, July 20, 2022

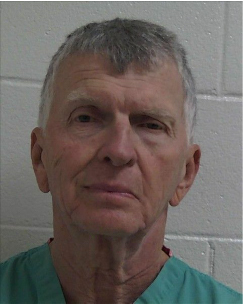

- Memorial Hospital and Manor CEO Jim Lambert and Hospital Authority Chairwoman Glennie Bench accept a $50,000 check from FNB’s Bert Hines, Shea Campbell, Brad Barber and Lorenda Smith.

|

Getting your Trinity Audio player ready...

|

First National Bank gave $50,000 to Memorial Hospital and Manor through the Georgia HEART Rural Hospital Tax Credit Program on Tuesday morning. Memorial Hospital and Manor has been serving the southwest Georgia community for the past 62 years, providing quality healthcare close to home for its local residents. Georgia’s rural hospitals have been facing a financial crisis for years due to demographic, economic, and industry challenges. The COVID-19 pandemic has imposed a whole new set of unique challenges on the state’s rural hospitals. The Georgia HEART Hospital Program administers the Rural Hospital Tax Credit, which was enacted by the Georgia General Assembly in 2016 to increase rural hospital funding and to further the hospitals’ ability to care for the thousands of Georgians who live in the communities they serve.

“We are very thankful for the support of our banking community,” said Memorial Hospital and Manor CEO, Jim Lambert. “First National Bank has been an active participant in the program for five years, giving in the amount totaling $215,000. These dollars are vital to our organization allowing us to purchase equipment and make much needed repairs to our aging facility. We greatly appreciate First National tax dollars local.”

Through HEART, Georgia taxpayers can make contributions in exchange for a 100% state income tax credit, up to specified limits, to qualified rural hospitals of their choice. “C” Corporations and Pass-Through Entity business owners who participate may also qualify for an additional federal business expense deduction. Essentially, individuals and business have the unique opportunity to pay their state income taxes – an expenditure they are required to make anyway – through contributing to rural hospitals.

“We know that quality healthcare is a critical component of quality of life,” said Brad Barber, President & CEO of First National Bank. “The Georgia HEART Rural Tax Credit Program is a tremendous asset to our rural hospitals. Through this program, First National Bank is very proud to contribute to a service that is much needed and will aid in providing access to high-caliber medical services for this community.”

Currently, 54 rural hospitals are qualified to receive these tax credit-eligible contributions from individuals and businesses across the state. Georgia taxpayers who are interested in participating in the HEART program are encouraged to visit www.georgiaheart.org to learn more. Georgia Heart will begin taking applications for 2023 beginning October 3, 2022.